Condo Insurance in and around Cedartown

Get your Cedartown condo insured right here!

Cover your home, wisely

Your Stuff Needs Coverage—and So Does Your Townhome.

When it's time to relax, the haven that comes to mind for you and your favorite peopleis your condo.

Get your Cedartown condo insured right here!

Cover your home, wisely

Put Those Worries To Rest

That’s why you need State Farm Condo Unitowners Insurance. Agent Michelle Ruper can roll out the welcome mat to help generate a plan for your particular situation. You’ll feel right at home with Agent Michelle Ruper, with a straightforward experience to get dependable coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Michelle Ruper can help you file your claim whenever the unforeseen lands on your doorstep. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

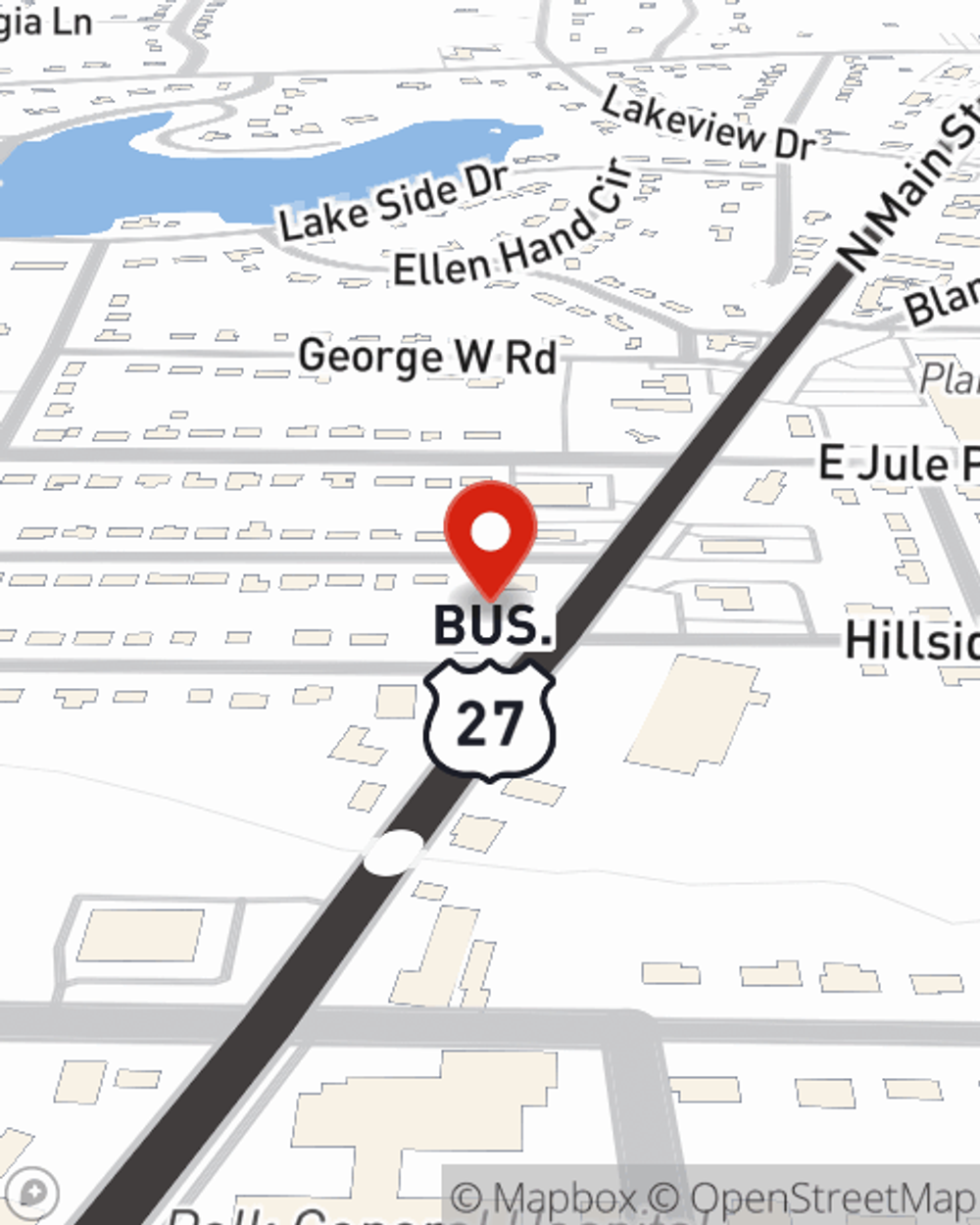

When your Cedartown, GA, condominium is insured by State Farm, even if life doesn't go right, State Farm can help cover your one of your most valuable assets! Call or go online now and find out how State Farm agent Michelle Ruper can help you protect your condo.

Have More Questions About Condo Unitowners Insurance?

Call Michelle at (770) 748-8771 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Michelle Ruper

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.