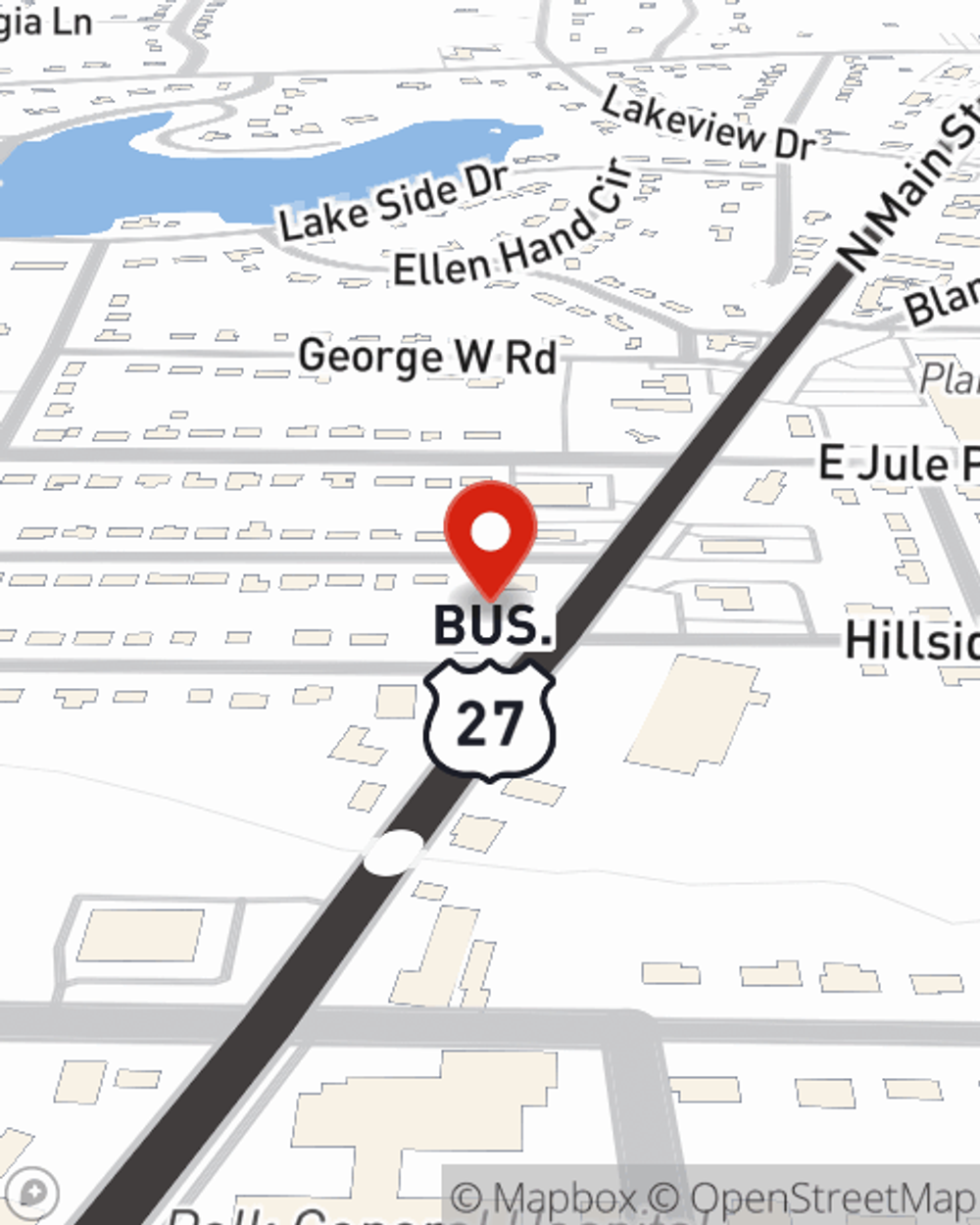

Business Insurance in and around Cedartown

Researching protection for your business? Look no further than State Farm agent Michelle Ruper!

Cover all the bases for your small business

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, extra liability coverage and errors and omissions liability, among others.

Researching protection for your business? Look no further than State Farm agent Michelle Ruper!

Cover all the bases for your small business

Small Business Insurance You Can Count On

At State Farm, apply for the excellent coverage you may need for your business, whether it's an art school, an ice cream shop or a florist. Agent Michelle Ruper is also a business owner and understands what you need. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Call Michelle Ruper today, and let's get down to business.

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Michelle Ruper

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.